The Real News Network has the interview Deficit Is Falling Because Of Government Austerity, Not Economic Recovery. The interviewee is economist Stephanie Kelton.

Stephanie Kelton, Ph.D. is Associate Professor and Chair of the Department of Economics at the University of Missouri-Kansas City. She is also Editor-in-Chief of the top-ranked blog New Economic Perspectives and a member of the TopWonks network of the nation’s best thinkers. Her book, The State, The Market and The Euro (2001) predicted the debt crisis in the Eurozone, and her subsequent work correctly predicted that: (1) Quantitative Easing (QE) wouldn’t lead to high inflation; (2) government deficits wouldn’t cause a spike in U.S. interest rates; (3) the S&P downgrade wouldn’t cause investors to flee Treasuries; (4) the U.S. would not experience a European-style debt crisis.

But what would she know about the subject of the interview? That last sentence is sarcasm on my part. I know I have to explain these things to some of my readers.

Upon hearing this brief interview, I remarked to Sharon that the trouble with it is that you have to understand how the monetary system works to know why she is exactly right in what she says. I then read the viewer comments on the interview.

The following comment is typical:

These economists are always blowing smoke. If all that matters is having a “productive economy” and if the govt can really just mail out checks to people without ever worrying about where the money will come from “since America is the only country who can legally create dollars,” then please tell me, O Enlightened Economist, WHY do I have to write a really FAT check to the federal govt every quarter to cover my taxes? Assuming the “unlimited dollars” theory is sound then why does anyone have to pay taxes to the federal govt? Can’t they just create all the dollars they need?

And all the while that economists like this are blathering about their “unlimited dollars” theories of federal spending, citizens like myself who regularly write out checks to the IRS for tens of thousands of dollars know where that money is coming from–it’s coming from OUR damn pockets.

I replied to the comment to see if I could straighten the person out (silly me.)

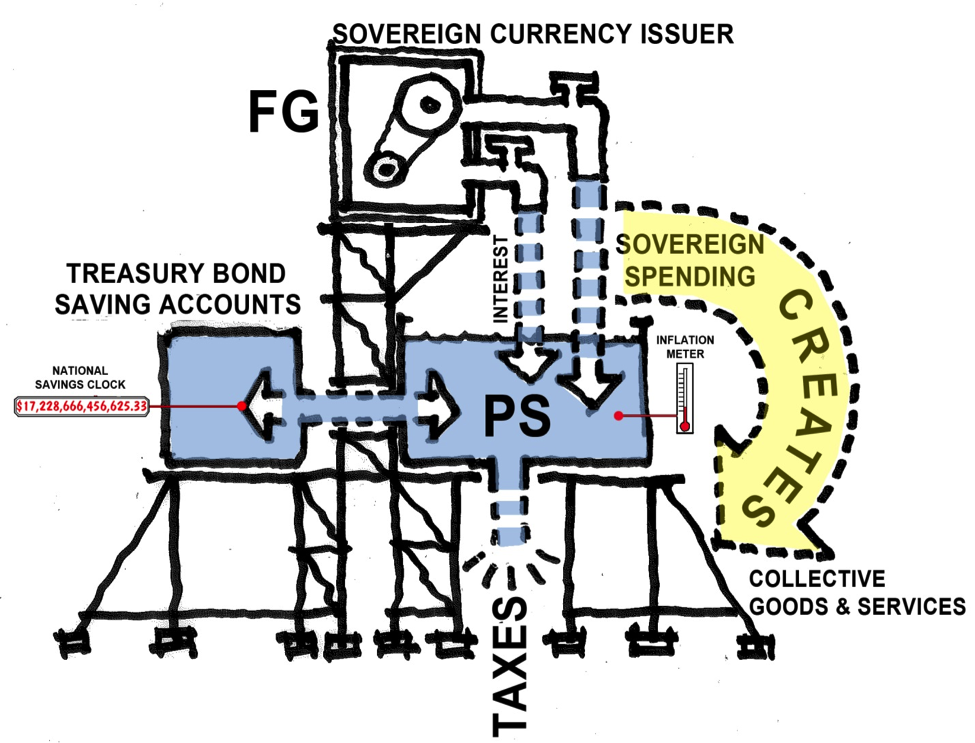

If you would actually follow the flow of money through the economy, you would find that when you pay your tax dollars to the federal government, they essential rip up the money. The money they spend is new money that the government creates. The collection of federal tax dollars has a number of reasons to be necessary for the economy. Some MMTers believe that having to pay taxes in dollars is what makes the dollar accepted as money. (I don’t buy that argument too much, because there are lots of people in this world outside this country that do not pay US taxes, but still use the dollar as a means of paying debts and accepting payment of debts.) The ability to pull in dollars in taxes is also what allows the government to control how much money is available compared to the amount of goods available so that we don’t have run-away inflation.

With the FED creating $85 billion a month in Quantitative Easying to bail out the financial system, at some point the liquidity that is being pumped into the economy and not being put to use, will start to flow back into the economy. To prevent inflation at that point, this excess will have to be sucked back out in the form of excess of taxes over spending.

There is recorded testimony by Ben Berbanke before a Senate Committee. They asked him where he was getting all the money he was using to buy assets in the QE program. He answered very honestly, “We just create the money.” It was so amazing that these supposed expert Senators didn’t know that and equally amazing that they were flabbergasted at the answer.

The trouble with what Kelton said, is that you have to understand the theory behind her remarks to understand why her comments are exactly correct. In an 8 minute interview, she hardly had time to give you a semester’s worth of economic education.

To understand the diagram –

http://neweconomicperspectives…,

follow the links in my blog post – Diagrams and Dollars: Modern Money Illustrated (Part 1 & 2)

http://neweconomicperspectives…,

http://neweconomicperspectives…,